As a business owner, you’re time is short. Between running the day-to-day operations of your business, whilst also scheduling in time for planning ahead for growth, there can be few, if any hours, left in the day. When leading such a life it really does pay to have the best tools to hand and from task management to financial management it seems that there is no area that can’t be helped, streamlined or aided with the assistance of an app or two. So here we hone in on the world of finance and business banking, which is of course a realm that every business person must seamlessly manage from day-to-day between the many (many) other things on their never ending task list.

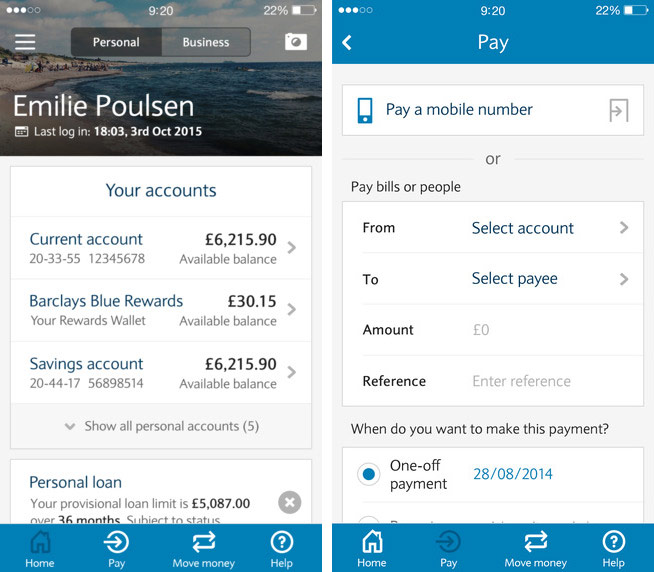

Barclays

Overview: Barclays could be said to have led the way within the banking realm recently, having pioneered ‘Barclays Cloud It’ – a service for business clients that allows for secure online storage of essential business documents. Add to this an announcement that as of 2016 they will support Apple Pay for their customers, as well as their freshly announced ‘Digital Cash Collection’ which will provide door to door cash collections – from their clients’ customers back into branch; it’s then of little surprise that Barclays equally lead the way with a seriously innovative business banking app.

Features: Pay new and existing payees; cancel direct debits; report cards as lost or stolen; rename accounts for ease of use; edit statement preferences; add images to debit cards; change your passcode; personalise the app itself and edit the settings to show account statements as you wish.

Benefits: The Barclays app could be said to have the best looking, and most user friendly interface of all the business banking apps listed here. Perhaps of most use however, is the fact that this really does serve as an all-in-one solution, where you can pay new payees without having to take to the desktop (a commonly missed feature for others apps) as well as a whole host of other tasks.

Compared to any one of the other banking leader’s offerings this is one seriously robust, feature rich and flexible option for banking on the go. It then seems that, in many ways, Barclays has opted for innovation once more to gain the competitive edge on their banking counterparts. This may also be seen within their business banking packages, which boast reduced charges the longer a business with them, as well as advice from accountants, marketing experts and solicitors for start-up businesses – all of which is unique within the market.

Score out of five: Five

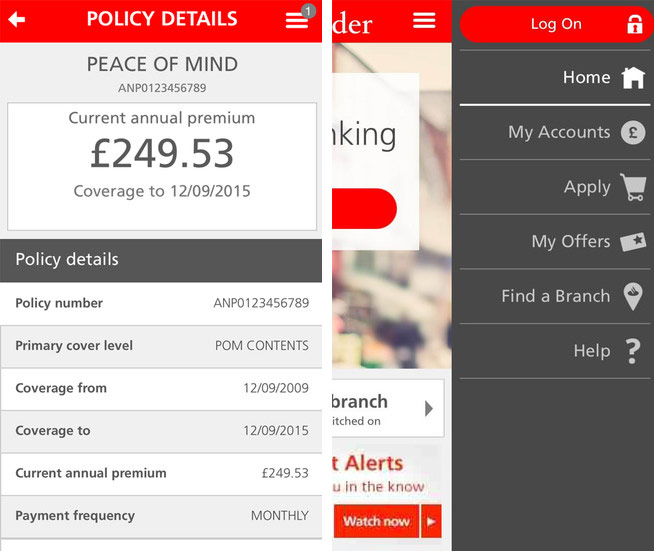

Santander

Overview: Santander has been gaining ground within both the commercial and personal realms of banking. However, this month’s news of account fee increases for personal customers has led to some business owners considering the future of their personal accounts, and consequently whether they would take their business account with them.

Nevertheless this Santander app provides for a respectable offering for the business person, with a couple of nice little features that are of particular note.

Features: Check balances and statements; send payments; view and set up alerts and create employee apps with limited features.

Benefits: One of the leading benefits that this app provides is that it allows for the user to see both their personal and business accounts all in one place, although this may not be ideal for all. This is also coupled with the option for employees to have their own app versions with limited features – which is a nicely considered addition for the business owner.

Lastly, this is also one of the few business banking apps that is provided for Android, Apple iOS and Blackberry.

Score out of five: Four and a half

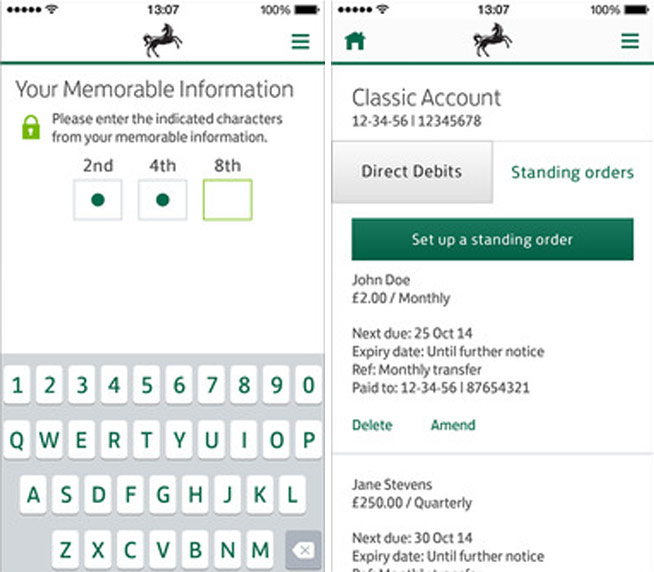

Lloyds

Overview: Having undergone a significant re-restructuring process Lloyds can be said to have now weathered a financial storm to re-define its market proposition. Now separate from its personalised banking brother ‘TSB’, they have also overhauled their app to, as they state, help business owners keep in touch with their finances.

Features: Three character log on; Payments to existing online payees; check balance and transactions and view and cancel standing orders and direct debits.

Benefits: Whilst the Lloyds business banking app boasts pretty good feedback and ratings upon the Google Play store and Apple iTunes store, it must be noted that this app provides for only the core tasks that a business user may need. Nevertheless, it is known for being super user friendly as well as fast and efficient for the basic, day-to-day banking ‘To-Dos’.

Score out of five: Three and a half

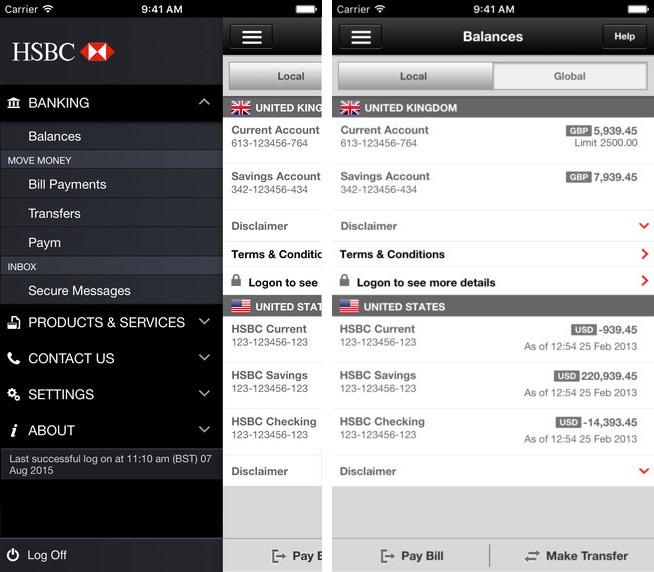

HSBC

Overview: HSBC are often known to be a bank with a good reputation and were one of the few that was relatively unaffected by the subprime banking crisis owing to their stringent approach to credit control. Having recently undertaken a number of re-designs of their business app it seems, however, that this bank could do well to further polish this aspect of their reputation as a leading personal and business bank.

Features: View balances and recent transactions; view transactions scheduled in for the next day; payments for existing beneficiaries and account transfers.

Benefits: Whilst the HSBC app re-design provides slicker graphics and interactions, the features are, by many accounts, pretty limited for the business person’s needs, although basic tasks can be undertaken quickly.

Score out of five: Three

NatWest

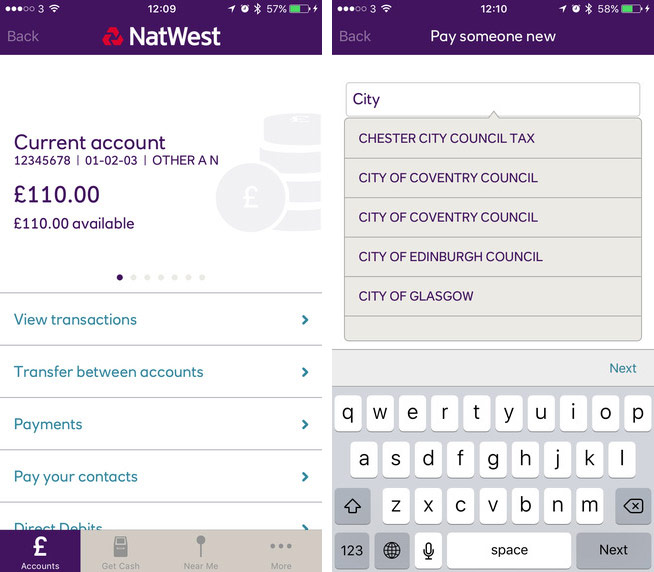

Overview: NatWest are pretty popular within the business banking realm being one of the top five most popular banks. Once more, however, it seems that their app could do with a few further features to better their offering to the business banking market.

Features: Manage any number of linked business accounts; check balances and statements for up to seven years of history; make payments to payees that have received payments previously via online banking; transfers and nearest branch and cash machine locator.

Benefits: The NatWest business banking app is regarded to be pretty intuitive (perfect for on-the-go business people who simply need to manage their basic finances quickly and easily).

Score out of five: Three